EMMA Fannie Mae 194 2011-2024 free printable template

Show details

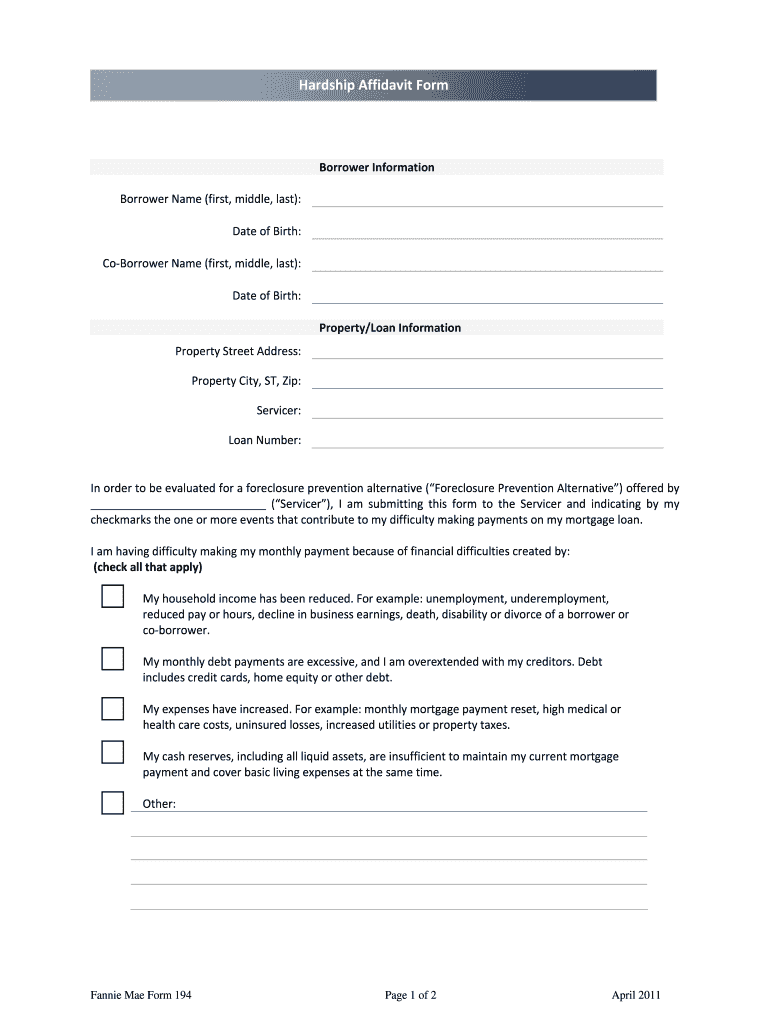

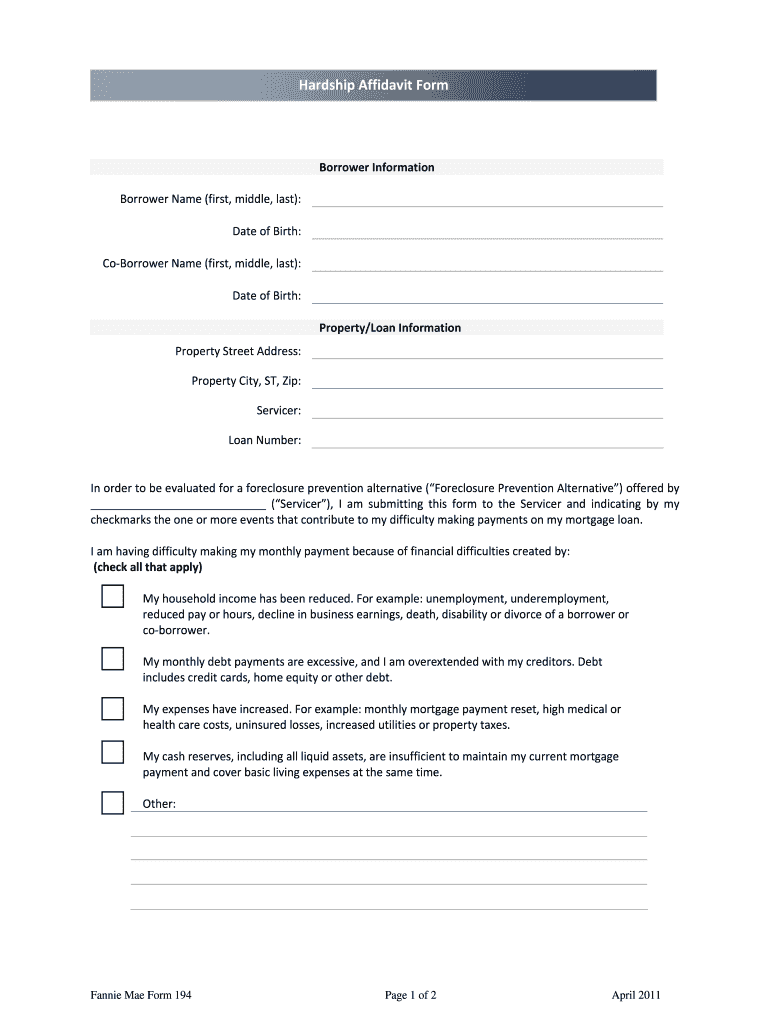

Hardship Affidavit Form Borrower Name (first, middle, last): Date of Birth: Co Borrower Name (first, middle, last): Date of Birth: Property Street Address: Borrower Information Property/Loan Information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fannie mae hardship affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae hardship affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fannie mae hardship affidavit form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fannie mae form 194. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out fannie mae hardship affidavit

How to fill out Fannie Mae hardship affidavit:

01

Obtain the Fannie Mae hardship affidavit form. This can be found on the Fannie Mae website or through your mortgage servicer.

02

Provide your personal information. Fill out your name, address, contact information, and other relevant details as required on the form.

03

Describe your financial hardship. Clearly explain the circumstances that have led to your financial hardship. This may include job loss, medical issues, divorce, or other significant events. Provide specific details and any supporting documentation if available.

04

Provide details of your current financial situation. Outline your current income, expenses, and assets. This includes your monthly income, expenses, and any other financial resources you have available. Be thorough and accurate in documenting your financial condition.

05

Complete the mortgage information section. Include details about your property, outstanding mortgage balance, monthly mortgage payment, and any other relevant mortgage details.

06

Sign and date the affidavit. Read through the affidavit carefully and make sure all the information provided is accurate. Sign the document and date it.

07

Submit the affidavit to your mortgage servicer. Follow the instructions provided on the form or contact your mortgage servicer to confirm how to submit the completed affidavit.

Who needs Fannie Mae hardship affidavit:

01

Homeowners facing financial hardship. Individuals who are experiencing significant financial difficulties and are struggling to make their mortgage payments may need to fill out a Fannie Mae hardship affidavit.

02

Homeowners with mortgage loans serviced by Fannie Mae. The Fannie Mae hardship affidavit is specifically designed for homeowners whose mortgage loans are serviced by Fannie Mae. It may not be applicable or necessary for homeowners with loans serviced by other entities.

03

Homeowners seeking mortgage assistance or modifications. The hardship affidavit is often required as part of the application process for mortgage assistance programs or loan modifications offered by Fannie Mae. It helps assess the homeowner's eligibility and determine the appropriate course of action to provide relief during financial hardship.

Fill form : Try Risk Free

People Also Ask about fannie mae hardship affidavit form

How do you write a simple hardship letter?

What should not be included in a hardship letter?

How do I write a hardship letter for mortgage assistance?

What not to put in a hardship letter?

What is an example of a hardship affidavit letter?

How do you write a financial hardship statement?

What is an example of a good hardship letter?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fannie mae hardship affidavit?

Fannie Mae Hardship Affidavit is a document that is required by Fannie Mae, a government-sponsored enterprise (GSE) in the United States, for borrowers who are facing financial difficulties and are seeking assistance or alternatives to foreclosure. The affidavit is used to formally explain and provide evidence of the borrower's financial hardship, such as job loss, reduction in income, medical expenses, divorce, or other circumstances that have made it challenging for them to continue making mortgage payments. The information provided in the hardship affidavit assists the loan servicer or lender in evaluating the borrower's eligibility for various foreclosure prevention options, such as loan modification, repayment plans, or short sale.

Who is required to file fannie mae hardship affidavit?

The Fannie Mae Hardship Affidavit is typically required to be filed by homeowners who are seeking mortgage assistance or loan modification options through Fannie Mae. It is used to provide detailed information about the financial hardship being faced by the homeowner and to assess their eligibility for potential assistance programs.

What is the purpose of fannie mae hardship affidavit?

The purpose of the Fannie Mae Hardship Affidavit is to provide detailed information to Fannie Mae, a government-sponsored enterprise that supports the mortgage market, regarding the financial circumstances and hardships faced by a homeowner who is struggling to make mortgage payments. The affidavit is often required as part of the loan modification or foreclosure prevention process when seeking assistance from Fannie Mae. It is used to evaluate eligibility for various loss mitigation options and to assess the homeowner's ability to afford modified mortgage terms. The document helps Fannie Mae better understand the homeowner's financial situation and make informed decisions on potential resolutions.

What is the penalty for the late filing of fannie mae hardship affidavit?

Fannie Mae does not specify a specific penalty for the late filing of a hardship affidavit. However, it is important to note that failing to submit the required documentation in a timely manner could impact the loan modification or foreclosure prevention process. It might lead to a delay or denial of assistance. It is always best to submit the necessary paperwork as soon as possible to avoid any potential negative consequences.

Where do I find fannie mae hardship affidavit form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fannie mae form 194 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in fannie mae hardship affidavit form?

With pdfFiller, the editing process is straightforward. Open your fannie mae form 194 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit fannie mae hardship affidavit form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute fannie mae form 194 from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your fannie mae hardship affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.